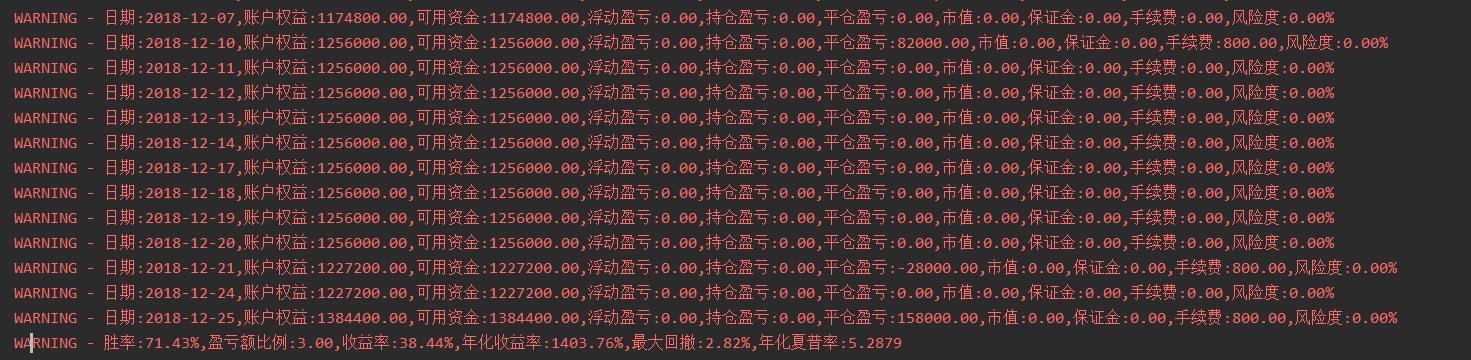

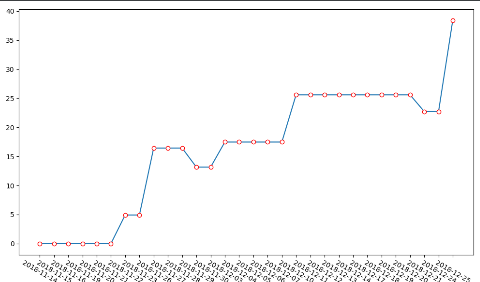

参数设置同博客,但最后收益率,年化夏普率,风险度和博客中有出入。请大神帮看~

# -*- coding: utf-8 -*-

"""

@Time : 2020/5/1 10:37

@Author : 小韭韭

@Email : fredialei@gmail.com

@File : RBreaker.py

@Software: PyCharm

"""

from datetime import date, datetime

from tqsdk import TqApi, TqSim, TqBacktest, BacktestFinished, TargetPosTask

SYMBOL = "INE.sc1905" # 合约代码

CLOSE_HOUR, CLOSE_MINUTE = 14, 50 # 平仓时间

STOP_LOSS_PRICE = 30 # 止损点(价格)

NUM = 20 # 手数

INIT_BALANCE = 1000000 # 初始权益

def figure_trade_log(acc, init_balance):

import matplotlib.pyplot as plt

plt.figure(figsize=(10, 6))

trade_log = acc.trade_log

x = []

y = []

for k, v in trade_log.items():

x.append(k)

y.append((v['account']['balance'] - init_balance) / init_balance * 100)

plt.plot(x, y, marker='o', mec='r', mfc='w')

plt.xticks(rotation=-30)

plt.show()

def get_index_line(klines):

'''计算指标线'''

high = klines.high.iloc[-2] # 前一日的最高价

low = klines.low.iloc[-2] # 前一日的最低价

close = klines.close.iloc[-2] # 前一日的收盘价

pivot = (high + low + close) / 3 # 枢轴点

bBreak = high + 2 * (pivot - low) # 突破买入价

sSetup = pivot + (high - low) # 观察卖出价

sEnter = 2 * pivot - low # 反转卖出价

bEnter = 2 * pivot - high # 反转买入价

bSetup = pivot - (high - low) # 观察买入价

sBreak = low - 2 * (high - pivot) # 突破卖出价

print("已计算新标志线, 枢轴点: %f, 突破买入价: %f, 观察卖出价: %f, 反转卖出价: %f, 反转买入价: %f, 观察买入价: %f, 突破卖出价: %f"

% (pivot, bBreak, sSetup, sEnter, bEnter, bSetup, sBreak))

return pivot, bBreak, sSetup, sEnter, bEnter, bSetup, sBreak

acc = TqSim(init_balance=INIT_BALANCE)

try:

api = TqApi(acc, backtest=TqBacktest(start_dt=date(2018, 11, 14), end_dt=date(2018, 12, 25)), web_gui=True)

target_pos = TargetPosTask(api, SYMBOL) # 默认对价下单

quote = api.get_quote(SYMBOL)

klines = api.get_kline_serial(SYMBOL, 60 * 60 * 24) # 日线

position = api.get_position(SYMBOL)

target_pos_value = position.pos_long - position.pos_short # 净目标净持仓数

open_position_price = position.open_price_long if target_pos_value > 0 else position.open_price_short # 开仓价

pivot, bBreak, sSetup, sEnter, bEnter, bSetup, sBreak = get_index_line(klines) # 七条标准线

while True:

target_pos.set_target_volume(target_pos_value)

api.wait_update()

if api.is_changing(klines.iloc[-1], "datetime"): # 产生新k线,则重新计算7条指标线

pivot, bBreak, sSetup, sEnter, bEnter, bSetup, sBreak = get_index_line(klines)

if api.is_changing(quote, "datetime"):

now = datetime.strptime(quote.datetime, "%Y-%m-%d %H:%M:%S.%f")

if now.hour == CLOSE_HOUR and now.minute >= CLOSE_MINUTE: # 到达平仓时间: 平仓

print("临近本交易日收盘: 平仓")

target_pos_value = 0 # 平仓

pivot = bBreak = sSetup = sEnter = bEnter = bSetup = sBreak = float("nan") # 修改各指标线的值, 避免平仓后再次触发

'''交易规则'''

if api.is_changing(quote, "last_price"):

# print("最新价: %f" % quote.last_price)

# 开仓价与当前行情价之差大于止损点则止损

if (target_pos_value > 0 and open_position_price - quote.last_price >= STOP_LOSS_PRICE) or \

(target_pos_value < 0 and quote.last_price - open_position_price >= STOP_LOSS_PRICE):

print("止损")

target_pos_value = 0 # 平仓

# 反转:

if target_pos_value > 0: # 多头持仓

if quote.highest > sSetup and quote.last_price < sEnter:

# 多头持仓,当日内最高价超过观察卖出价后,

# 盘中价格出现回落,且进一步跌破反转卖出价构成的支撑线时,

# 采取反转策略,即在该点位反手做空

print("多头持仓,当日内最高价超过观察卖出价后跌破反转卖出价: 反手做空")

target_pos_value = -NUM # 做空

open_position_price = quote.last_price

elif target_pos_value < 0: # 空头持仓

if quote.lowest < bSetup and quote.last_price > bEnter:

# 空头持仓,当日内最低价低于观察买入价后,

# 盘中价格出现反弹,且进一步超过反转买入价构成的阻力线时,

# 采取反转策略,即在该点位反手做多

print("空头持仓,当日最低价低于观察买入价后超过反转买入价: 反手做多")

target_pos_value = NUM # 做多

open_position_price = quote.last_price

# 突破:

elif target_pos_value == 0: # 空仓条件

if quote.last_price > bBreak:

# 在空仓的情况下,如果盘中价格超过突破买入价,

# 则采取趋势策略,即在该点位开仓做多

print("空仓,盘中价格超过突破买入价: 开仓做多")

target_pos_value = NUM # 做多

open_position_price = quote.last_price

elif quote.last_price < sBreak:

# 在空仓的情况下,如果盘中价格跌破突破卖出价,

# 则采取趋势策略,即在该点位开仓做空

print("空仓,盘中价格跌破突破卖出价: 开仓做空")

target_pos_value = -NUM # 做空

open_position_price = quote.last_price

except BacktestFinished as e:

figure_trade_log(acc, INIT_BALANCE)

但应该不会很大